Wage theft is no longer just a “mistake” or an administrative oversight—it’s a criminal offence. In Australia, the introduction of tough new laws means businesses caught underpaying their workers could face fines of up to $1.1 million and, in severe cases, jail time of up to 10 years.

As a small business owner, you may not intentionally underpay your workers, but even unintentional errors can now have dire consequences. Understanding what wage theft is, the common pitfalls that lead to it, and how to proactively safeguard your business has never been more critical.

What Is Wage Theft?

Wage theft occurs when an employer fails to pay workers their full legal entitlements. This can include:

- Underpayment of wages: Paying below the minimum wage or incorrect award rates.

- Missed entitlements: Failing to pay allowances, penalty rates, or leave entitlements.

- Superannuation breaches: Delayed or missed superannuation payments.

- Unpaid hours: Not compensating workers for all hours worked, including overtime, preparation, or travel time.

These breaches aren’t just unethical—they’re now criminal. Regulators no longer differentiate between deliberate misconduct and honest mistakes. If your business is found to have underpaid workers, you will face the consequences regardless of intent.

Common Traps That Lead to Wage Theft

- Incorrect Award Classifications

Misclassifying workers under the wrong pay level or award is one of the most common mistakes. Awards are complex, with different levels, allowances, and penalties for different types of work and industries. Small errors in interpretation can lead to significant underpayments over time. - Missed Superannuation Payments

Superannuation is often overlooked, especially for casual workers or when calculating commissions, bonuses, or other less straightforward pay arrangements. Late or missing payments not only impact workers but also put you on the wrong side of the law. - Unpaid Overtime or Additional Hours

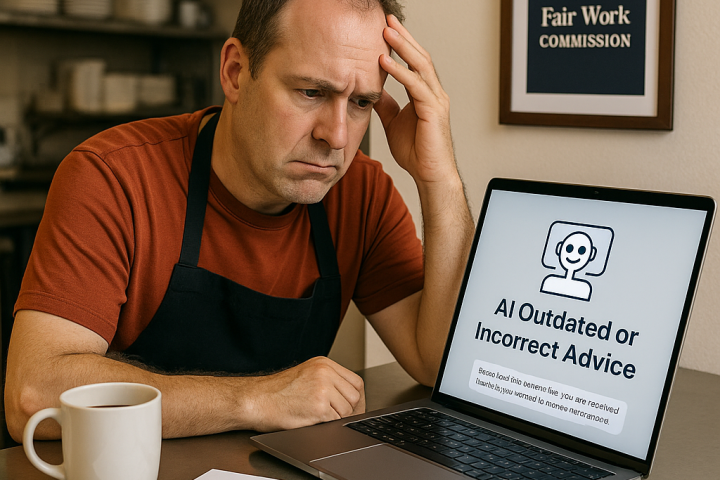

Failing to track all hours worked can lead to unpaid overtime. This includes preparation before shifts, travel between work sites, or time spent answering work-related calls or emails outside standard hours. - Outdated Payroll Systems

Many small businesses rely on outdated or poorly configured payroll software. These systems may not account for the latest award updates or changes in legislation, leading to errors that add up over time. - Casual Conversion Obligations

With changes to casual employment laws, failing to offer conversion to permanent roles where required can also lead to underpayment claims.

What Do the New Wage Theft Laws Mean for Employers?

From 1 January 2025 the new laws aim to hold employers accountable for underpaying their workers, regardless of intent. This heightened accountability comes with severe penalties:

- For individuals: Fines of up to $222,000 and up to 10 years in prison.

- For businesses: Fines of up to $1.1 million per offence.

Regulators, including the Fair Work Ombudsman (FWO), are stepping up audits and investigations, and workers are being encouraged to report underpayment. The message is clear: ignorance is no excuse.

What Can Small Business Owners Do?

The best way to protect your business is to be proactive. Here are some steps you can take:

- Conduct a Full Payroll Audit

Review your current payroll system, award classifications, and payment records. Ensure every worker is being paid correctly, including allowances, penalty rates, and superannuation. Alternatively, reach out to us (AHR) and or your Bookkeeper or Accountant to conduct the audit. - Keep Up with Award Changes

Awards and workplace laws are updated regularly. Make sure you’re staying informed about changes that apply to your industry. - Invest in Reliable Payroll Software

Upgrade to a payroll system that is configured to comply with the latest awards and legislation. Automation can significantly reduce the risk of human error. - Train Your Management Team

Ensure that your managers and supervisors understand the importance of compliance. Miscommunications about hours worked or entitlements often stem from poor training. - Engage Experts for Ongoing Support

Navigating Australia’s workplace laws is complex, and mistakes can be costly. Working with HR and IR experts can provide you with peace of mind and ensure your business remains compliant.

Why Assurance HR?

At Assurance HR, we understand the pressures small business owners face. Balancing day-to-day operations with the ever-changing landscape of workplace laws is a challenge, but you don’t have to do it alone.

We’re the Workplace Problem Solvers, specialising in HR, IR, and WHS compliance. Our team can:

- Conduct a thorough audit of your payroll and superannuation processes.

- Ensure your workers are classified and paid correctly under the relevant awards.

- Provide practical advice on compliance with the latest wage theft laws.

With our support, you can protect your business from fines, legal disputes, and reputational damage.

Don’t Risk Your Business—Act Now

Wage theft laws are here to stay, and the consequences for getting it wrong are severe. Small business owners must act now to ensure compliance.

Contact Assurance HR today to schedule a compliance review. Visit

call 1800 577515 , email info@assurancehr.com.au or “Book a Consultation” to learn how we can help safeguard your business.

Taking action today could save your business tomorrow.