In recent years, the landscape of Australian employment has been marred by a concerning trend: wage underpayment. This phenomenon has affected a multitude of prominent companies across various industries, causing not only financial repercussions but also significant damage to their reputations. From household names in the food and retail sectors to major players in finance and aviation, no sector seems immune to the risks posed by unintentional underpayment, often referred to as ‘wage theft.’ In this comprehensive guide, we explore the intricate facets of wage underpayment, from its root causes to detection, remediation, prevention, and communication strategies.

Understanding Wage Underpayment:

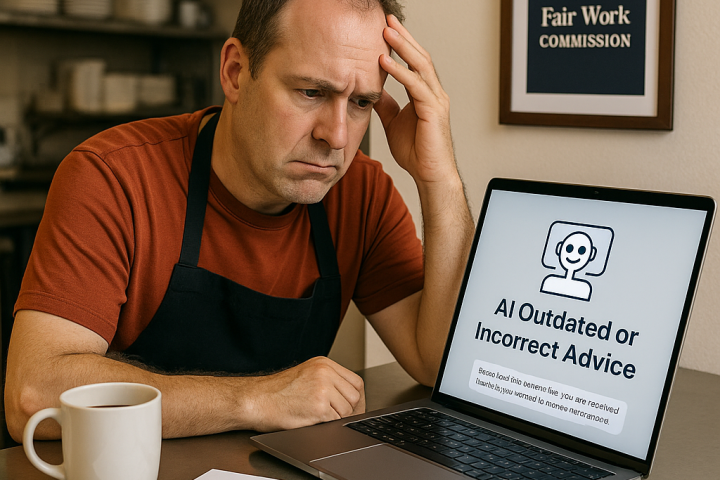

Wage underpayment can arise from both deliberate actions and inadvertent errors. While deliberate underpayment involves the intentional manipulation of records to conceal wage discrepancies, the majority of cases stem from employers grappling with the complexities of interpreting and applying correct salary entitlements. This complexity is compounded by the intricate nature of modern awards and employment legislation in Australia, presenting a formidable challenge for employers striving to comply with legal obligations while ensuring fair compensation for their employees.

Detecting Wage Underpayment:

Detecting wage underpayment poses a significant challenge for employers, often remaining unnoticed until an employee raises a claim or during internal audits. Identifying the extent of underpayment requires meticulous calculation, considering factors such as the number of affected employees, the magnitude of underpayment, and the quality of record-keeping practices. Employers must establish robust mechanisms for monitoring and auditing payroll processes to promptly identify and address any discrepancies.

Addressing Wage Underpayment:

Addressing wage underpayment necessitates comprehensive remediation efforts, including accurate calculations of owed amounts and timely repayments to affected employees. Employers may also opt to seek external assistance from employment lawyers and auditors to ensure compliance with legal requirements and mitigate potential legal risks. Transparent communication with employees regarding the issue and the remediation process is essential to maintain trust and uphold ethical standards within the organisation.

Preventing Wage Underpayment:

Preventing wage underpayment requires a proactive approach, beginning with a thorough understanding and interpretation of relevant awards and legislation governing employee entitlements. Employers should engage external legal counsel to navigate the complexities of salary calculations and preemptively address potential discrepancies. Implementing robust record-keeping systems and leveraging technology solutions can enhance accuracy and efficiency in payroll management, reducing the likelihood of underpayment incidents.

Navigating Communication and Reputation Management:

Effective communication and reputation management are critical components of addressing wage underpayment issues. Employers must carefully strategize their approach to communication, considering the scale of the issue and the potential involvement of external stakeholders such as unions and industry groups. Proactive engagement with regulatory bodies like the Fair Work Ombudsman demonstrates a commitment to rectifying issues and upholding ethical standards, thereby mitigating reputational damage and fostering trust among stakeholders.

Key Considerations:

Prioritising compliance with wage regulations and seeking external advice are paramount to ensuring accuracy in salary calculations and mitigating legal risks.

Transparent communication and proactive engagement with stakeholders are essential for managing reputation during wage underpayment crises and maintaining employee trust.

Implementing robust systems and processes can help prevent wage underpayment, safeguarding both employer and employee interests and fostering a culture of compliance and fairness within the organisation.

Conclusion:

While wage underpayment remains a prevalent issue in the Australian employment landscape, employers can take proactive measures to mitigate risks and uphold ethical standards. By prioritising compliance, seeking external advice, and fostering transparent communication, employers can navigate wage underpayment challenges effectively while safeguarding their reputation and maintaining trust among employees and stakeholders alike.